Motorola Solutions (MSI) slips as Q4 outlook and targets stay in focus

Motorola Solutions is trading lower today even after posting strong Q3 results and guiding Q4 revenue above the Street, with the stock sitting well below its 52-week peak as broader markets retreat.

Drivers and today’s move

Motorola Solutions shares are weaker in early trading on Nov 4, 2025, recently around $391.50, down about 3.7% on the day. The stock sits roughly 23% below its 52-week high of $507.82, with today’s range between $391.21 and $406.39. The 52-week range now spans $388.90 to $507.82.[1]

The downdraft mirrors a broader risk-off tone across U.S. equities, with major indexes lower after warnings from large banks about a possible market pullback. Technology and growth shares are leading declines, and volatility is ticking up as investors reassess near-term macro risks.[2]

Against that backdrop, investors are processing Motorola Solutions’ latest update. Late last week the company lifted its outlook and projected fourth-quarter revenue growth slightly above consensus, citing steady demand for public safety and enterprise security offerings.[3]

Macro context

U.S. stocks opened broadly lower today as profit taking hit recent winners and policy uncertainty lingered ahead of upcoming economic data. The shift in risk appetite has weighed on several tech and software names and spilled over to communications equipment peers.[2]

For Motorola Solutions, macro sensitivity is buffered by government and public safety budgets, which tend to be less cyclical than commercial IT spending. Still, tighter financial conditions and a strong dollar can affect order timing and video security hardware mix.

On Monday, shares fell 3.7% amid a mixed tape, marking a fifth straight decline and reinforcing that broader market swings remain an important driver of near-term price action.[4]

Valuation snapshot

Based on Reuters compilation, Motorola Solutions trades near the low $390s with a trailing P/E around the low-to-mid 30s, a price-to-sales multiple near 6, and price-to-book above 25. Dividend yield screens around 1% on recent prices.[7][1][8]

Street targets cluster in a tight band. MarketWatch lists an average 12-month target near $502 on roughly mid-teens coverage, while Yahoo Finance shows an average of $498.44 with a range of $465 to $525. Several providers therefore imply upside from current levels, though the dispersion reflects different measures and contributor mixes.[9][10][11]

Earnings and guidance

On Oct 30, 2025, Motorola Solutions reported Q3 results that topped expectations. Revenue was cited at about $3.01 billion versus $2.99 billion expected, and adjusted EPS of $4.06 beat the $3.85 consensus. Management also guided fourth-quarter revenue growth to roughly 11%, slightly above the 10.8% analysts expected at the time.[3]

In the company’s press release, CEO Greg Brown called Q3 “outstanding” and noted robust demand for safety and security solutions, including contributions from recent acquisitions. Management raised earnings expectations for the year and highlighted continued strength across land mobile radio, video security and command center software.[5]

“Demand for our safety and security solutions remains robust.”[5]

The investor materials page provides the full package of tables and the webcast replay for further details on segment performance, backlog and operating cash flow.[6]

Looking ahead, Barron’s calendar indicates Motorola Solutions is slated to report fiscal year 2025 results on Feb 5, 2026, which would frame the next formal checkpoint for guidance and backlog trends.[12]

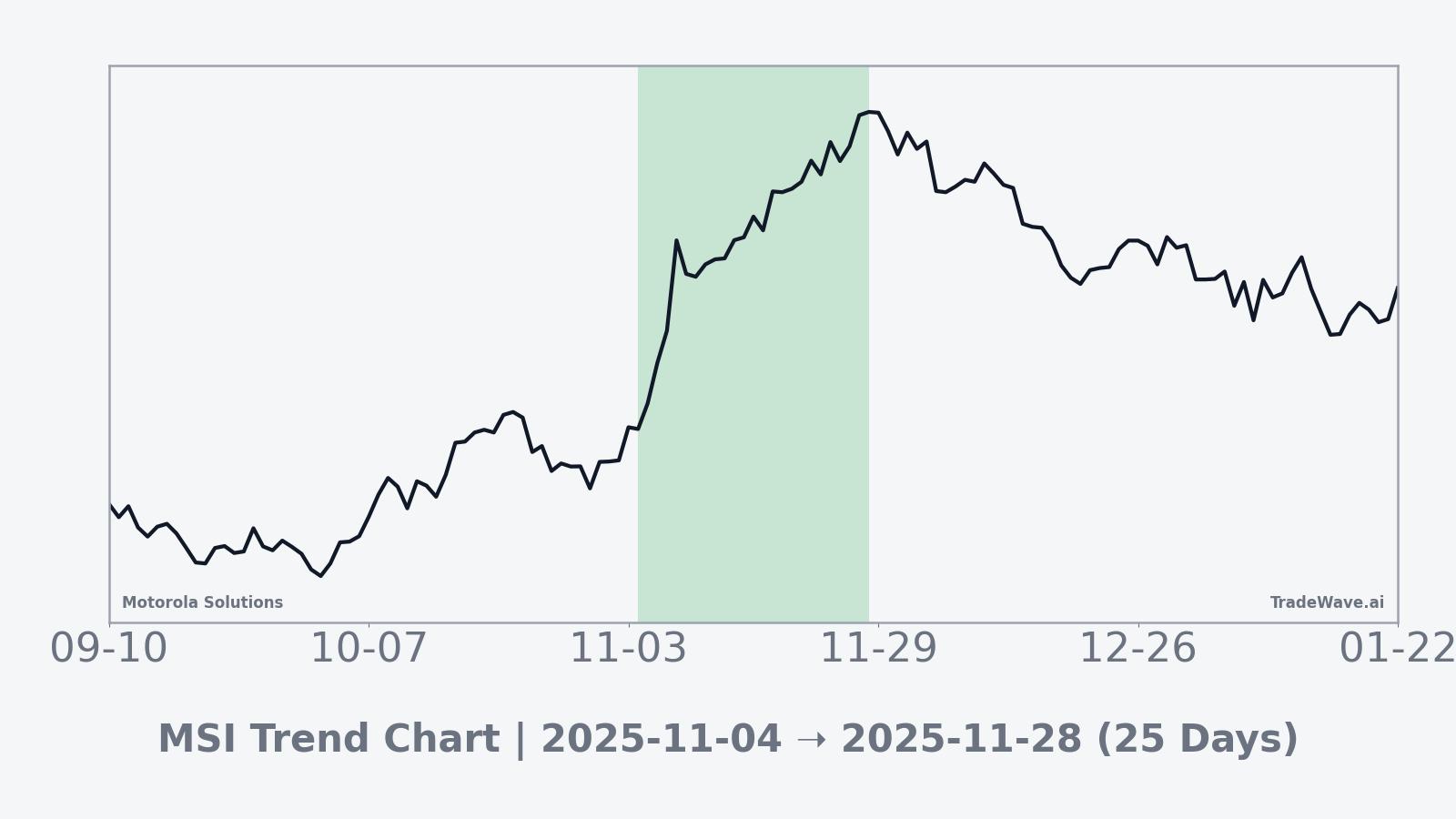

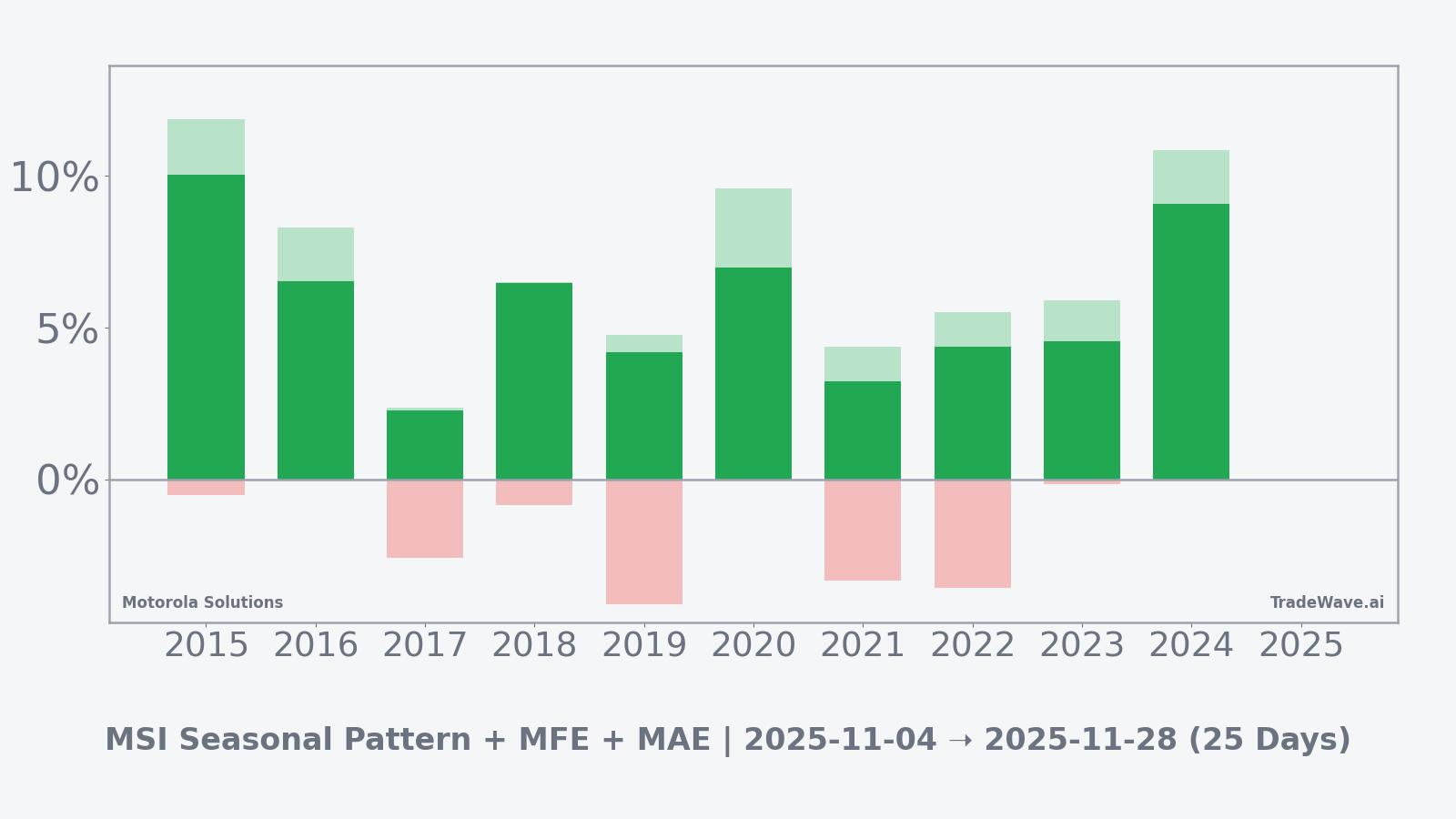

Seasonal setup starting Nov 4

Motorola Solutions enters a seasonal window beginning on Nov 4, 2025 and running 25 trading days, long direction, based on 10 years of history. Across those ten prior periods, the success rate was 100% with 10 winners and 0 losers, an average profit of 5.77%, a TradeWave Ratio of 2.21, and a Sharpe ratio of 2.2.

TradeWave defines the TradeWave Ratio as how far price typically travels in the trade direction within the window, independent of the final close. Together with Sharpe ratio, it offers a quick view of historical risk-adjusted outcomes.

Excursions inside the window show how paths can vary even when end points are favorable. The best point-to-peak upside in this sample appeared in 2024 with a maximum favorable excursion of 10.83%, while the worst mid-window drawdown came in 2019 with a maximum adverse excursion of 4.09% from entry. On a per-year basis, 2015 was among the strongest closes with a 10.02% net return, while 2017 was the mildest at 2.27%.

Risk note: Seasonal studies summarize history only. History does not guarantee future results, and MAE can be large even in winning windows.

Wrap-up

Today’s weakness leaves Motorola Solutions well below its November 2024 high watermark even as fundamentals remain firm and guidance points to continued growth. Valuation sits above the market average, but Street targets imply potential upside from current levels. The seasonal window that begins today has printed favorable outcomes in each of the past ten years on TradeWave’s definitions, with excursions that help frame both opportunity and risk.

What to watch: Q4 execution and the Feb 5, 2026 full-year report for order momentum and backlog color; price action around the mid-$380s to low-$390s recent lows versus any rebound toward the $430s and the $507.82 52-week high; whether consensus targets near $498 to $507 shift after year-end prints and fresh guidance.

Sources

- “Motorola Solutions Inc — Price and Volume Key Metrics,” Reuters, Nov 4, 2025. https://www.reuters.com/markets/companies/msi/key-metrics/price-and-volume/

- “Wall St falls after big banks warn of market pullback,” Reuters, Nov 4, 2025. https://www.reuters.com/business/futures-tumble-after-wall-st-banks-warn-market-pullback-palantir-slides-2025-11-04/

- “Motorola Solutions forecasts fourth-quarter revenue above estimates on steady demand,” Reuters, Oct 30, 2025. https://www.reuters.com/technology/motorola-forecasts-fourth-quarter-revenue-above-estimates-steady-demand-2025-10-30/

- “Motorola Solutions Reports Third-Quarter 2025 Financial Results,” Motorola Solutions press release, Oct 30, 2025. https://www.motorolasolutions.com/newsroom/press-releases/motorola-solutions-reports-q3-2025-financial-results.html

- “Earnings and SEC Filings,” Motorola Solutions Investor Relations, accessed Nov 4, 2025. https://www.motorolasolutions.com/investors/earnings-and-sec-filings.html

- “Research & Ratings: Calendar and Targets — MSI,” Barron’s, accessed Nov 4, 2025. https://www.barrons.com/market-data/stocks/msi/research-ratings

- “Motorola Solutions Inc — Valuation Key Metrics,” Reuters, accessed Nov 4, 2025. https://www.reuters.com/markets/companies/msi/

- “Motorola Solutions (MSI) Dividend History,” Nasdaq, accessed Nov 4, 2025. https://www.nasdaq.com/market-activity/stocks/msi/dividend-history

- “Motorola Solutions Inc. Analyst Estimates,” MarketWatch, accessed Nov 4, 2025. https://www.marketwatch.com/investing/stock/msi/analystestimates

- “MSI Analyst Price Targets,” Yahoo Finance Research, accessed Nov 4, 2025. https://finance.yahoo.com/research/stock-forecast/MSI/

- “Motorola Solutions Inc. — Research Ratings,” The Wall Street Journal, accessed Nov 4, 2025. https://www.wsj.com/market-data/quotes/MSI/research-ratings

- “Losses for Big Tech pull Wall Street lower,” Associated Press, Nov 4, 2025. https://apnews.com/article/c339a15fc5beb5a9a95510bde3c8a726

- “Motorola Solutions stock underperforms Monday when compared to competitors,” MarketWatch, Nov 3, 2025. https://www.marketwatch.com/data-news/motorola-solutions-inc-stock-underperforms-monday-when-compared-to-competitors-0bff05f0-59090d19e991