Analog Devices (ADI) heads into a historically strong seasonal window

Analog Devices is nearing a long seasonal stretch that has often favored the bulls, just as the stock digests a recent pullback and investors reassess its role across industrial, automotive and AI-linked chip demand.

Key takeaways

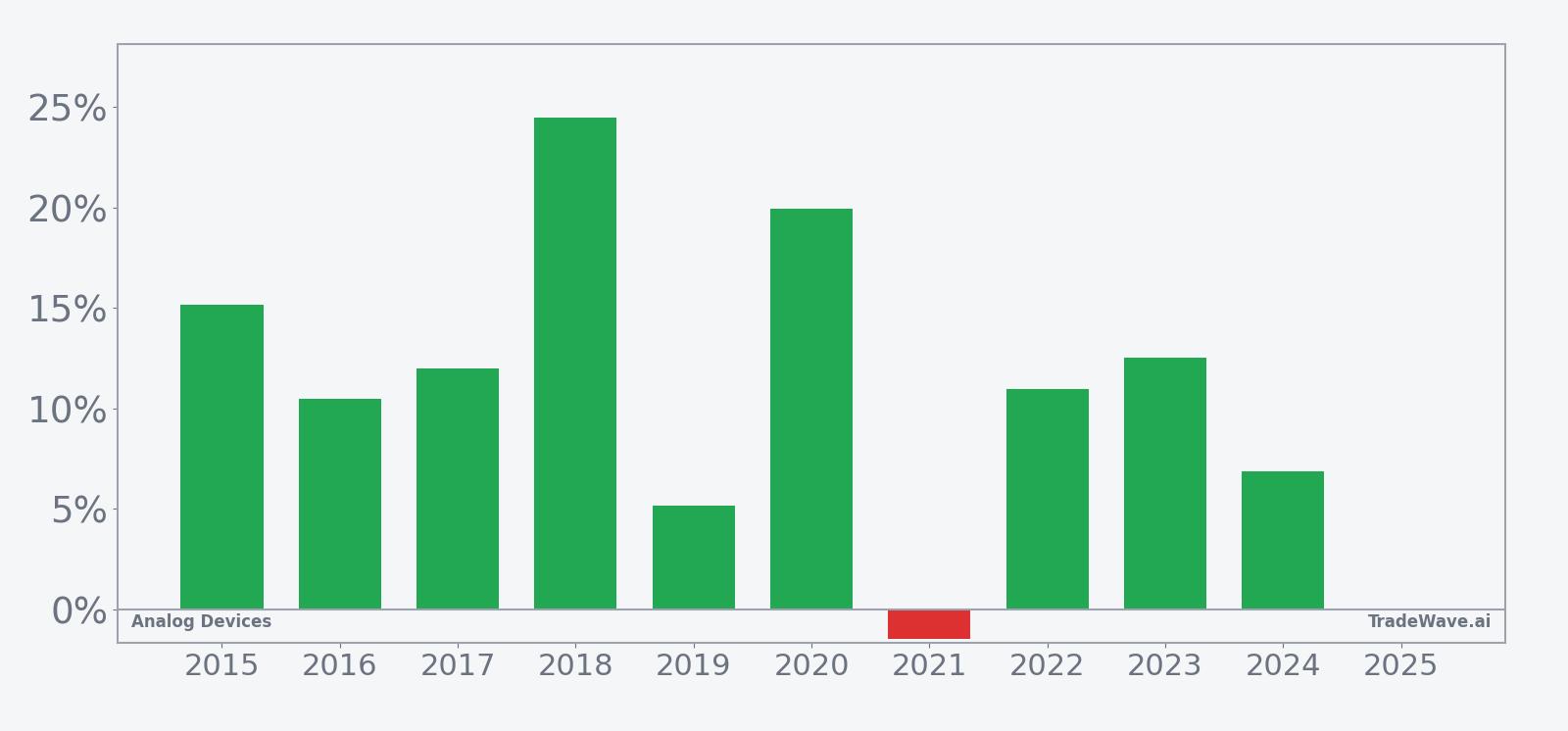

- A 247-day seasonal window for Analog Devices begins on Dec 9, based on the past 10 years of trading history.

- The pattern has a long-side bias, with 90% of years profitable, including 9 winners and 1 loser over the sample.

- Average gain in winning years has been 13.05%, while the all-years average, including the lone loss, is 12%.

- Historical paths show sizable upside bursts in strong years but also meaningful drawdowns inside the window, especially in 2019, 2021 and 2024.

- The 10-year seasonal trend points to a generally upward profile that often accelerates after early volatility.

- Investors should treat the window as a context tool rather than a forecast, given the potential for large adverse swings even in years that finish higher.

According to historical data from TradeWave.ai, this upcoming stretch for Analog Devices has displayed a distinct seasonal character in recent years. The next section looks at how that pattern has behaved and how it fits alongside today’s backdrop.

Seasonal window

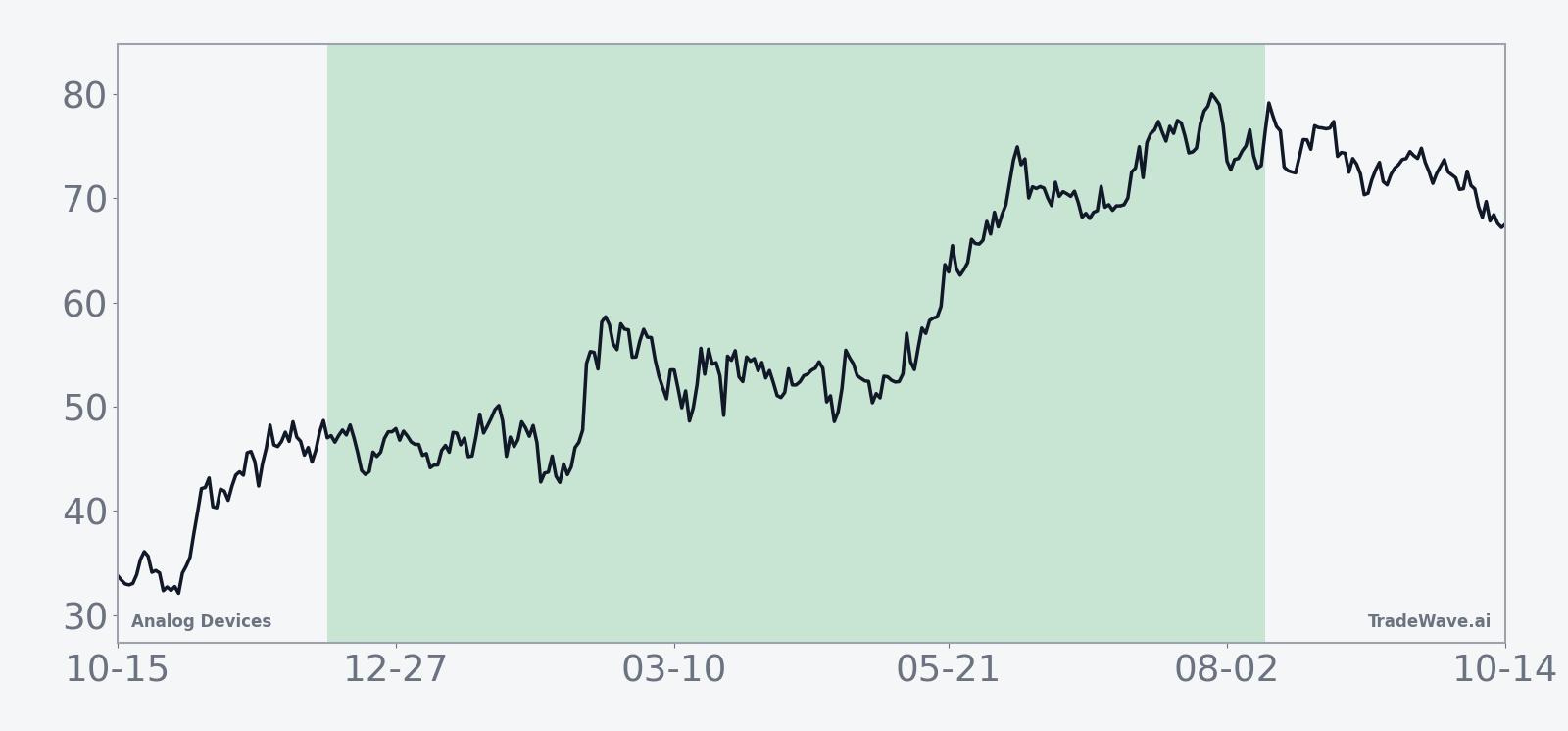

This seasonal window begins on 2025-12-09 and spans 247 days. Historically, during this period, Analog Devices has shown a strong upward tendency for long positions, with the stock recently pulling back about 5.3% even as investors weigh its role across industrial, automotive, consumer and communications end markets.[1]

Across the past decade, this long-biased window has produced 9 winning years and just 1 losing year, with 90% of outcomes finishing positive for the period. Average gains in those winning years have been 13.05%, while including the single down year brings the all-years average to 12%, suggesting that losses have historically been contained relative to the stronger up years.

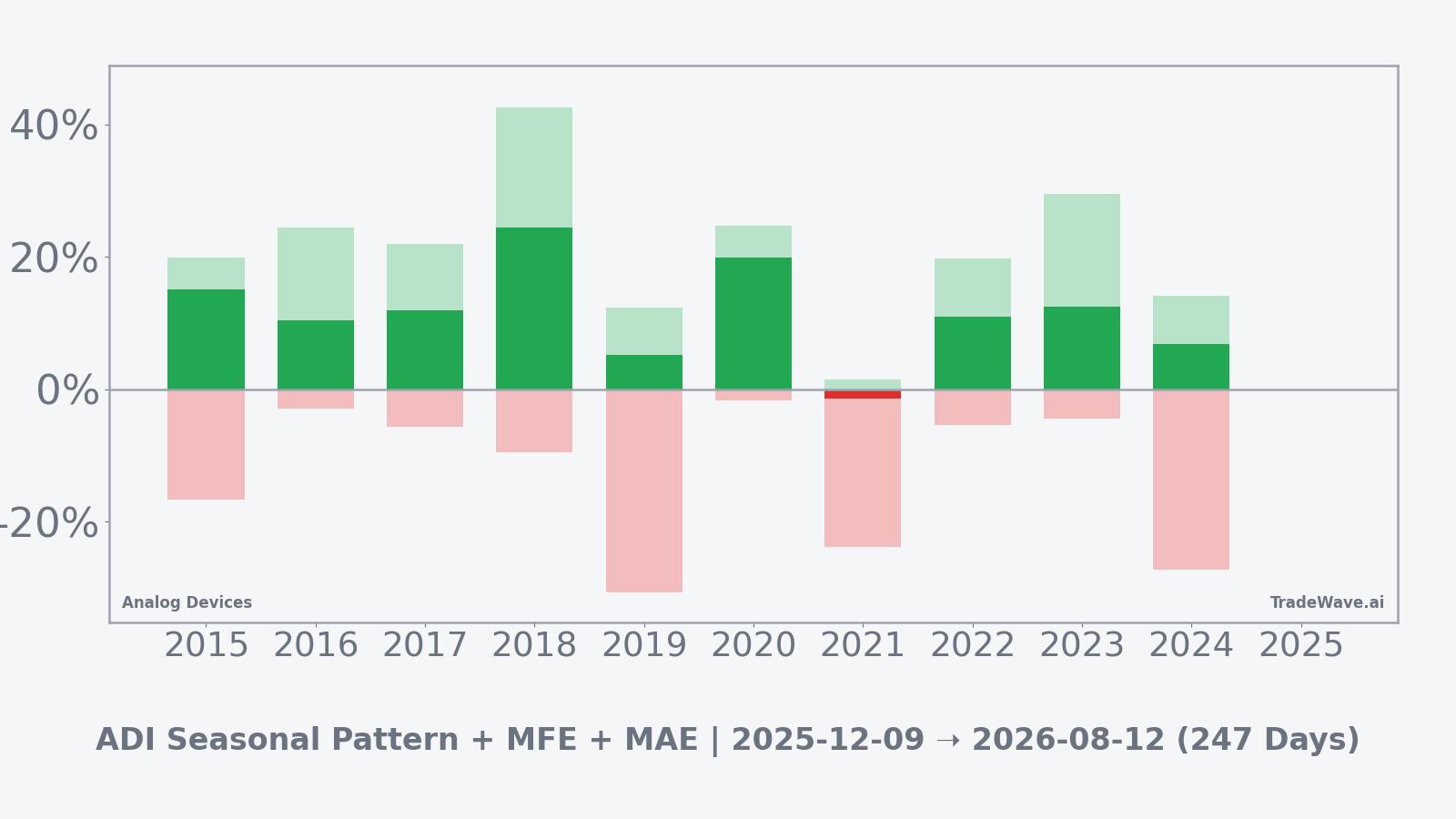

The per-year breakdown shows that 2018 was the standout, with a net return of 24.46% and a maximum favorable move of 42.54% from the entry point, while 2021 was the lone losing year, slipping 1.47% and experiencing a worst intraperiod drawdown of 23.88% from entry. That contrast highlights how the window has often rewarded patience on the upside but has also featured episodes of sharp downside volatility inside otherwise constructive regimes.

The 10-year average seasonal trend suggests a generally upward-sloping path, with gains tending to build over the life of the window rather than arriving in a single burst. In several years, including 2015, 2017 and 2020, the stock advanced steadily after an initial consolidation, while in others such as 2019 and 2024, deeper early drawdowns were followed by recoveries that still left the period in positive territory.

Yearly net and peak moves highlight how upside potential and downside risk have coexisted within this window.

The combined net, maximum favorable and maximum adverse excursion view shows that in strong years such as 2018 and 2020, Analog Devices not only finished higher but also saw sizable peak run-ups relative to entry, while years like 2019, 2021 and 2024 featured large intraperiod drawdowns of 23% to more than 30% even when the final result was modestly positive. That profile points to a window where the long-side edge has historically come with meaningful volatility, and where timing inside the period has mattered for realized experience.

History does not guarantee future results; adverse excursions (MAE) can be large even in winning windows.

Taken together, the historical pattern defines the quantitative seasonal backdrop for the current period.

Price and near-term drivers

Analog Devices shares have recently come under pressure, with the stock down about 5.3% in the latest stretch as investors rotate within the semiconductor complex and reassess relative value between analog and memory names.[5] The move comes against a backdrop where some commentators have argued that Analog Devices could be positioned for significant growth under a Trump 2.0 policy mix, pointing to its performance during the prior administration and the potential for tariff fears to be overstated.[1]

That political angle sits alongside more traditional drivers for the company, including its diversified exposure to industrial, automotive, consumer and communications markets, where its signal-processing chips help connect the physical and digital worlds.[1] The same analysis highlights Analog Devices’ role in emerging areas such as AI-enabled automotive systems and health technology, including radar collaborations and chips for personal health monitoring wearables, which could support demand even if broader semiconductor spending becomes more cyclical.[1]

Sector peers have delivered a mixed signal in recent months, with some AI-focused names rallying on data center demand while others have stumbled on guidance or valuation concerns, underscoring how stock-specific execution and positioning can matter as much as the macro narrative.[2][4][6] For Analog Devices, the absence of fresh earnings or guidance updates in the latest data leaves investors leaning more heavily on macro, policy and sector read-throughs as they look ahead to the new seasonal regime.

The chart below situates the latest move in its recent multi-month context.

Earnings and guidance context

The latest dataset does not include a specific upcoming earnings date or fresh quarterly results for Analog Devices, which means there is limited company-specific information to refine expectations around the start of this seasonal window.[1] There is also no formal forward guidance captured in the current materials, leaving investors to extrapolate from the company’s long-term positioning in industrial and automotive markets and from broader semiconductor demand trends.

By contrast, several peers in the chip space have recently reported detailed earnings and outlooks, with some AI-exposed names delivering strong growth but still seeing share price volatility when guidance failed to clear elevated expectations.[2][3][6] That pattern serves as a reminder that even for companies with solid structural stories, the market can react sharply to any perceived shortfall or shift in tone once management teams update their outlooks.

Macro and policy backdrop

Macro and political factors could play an outsized role for Analog Devices over the coming year, particularly if a Trump 2.0 administration pursues policies similar to those seen in the prior term.[1] Commentary from some strategists argues that the company flourished under the earlier policy mix and could again benefit from a combination of pro-business measures and misunderstood tariff risks, which might weigh more heavily on competitors with different geographic or product exposures.[1]

At the same time, the semiconductor industry remains deeply cyclical and sensitive to global growth, capital spending and supply-chain dynamics, so any shift in trade policy or industrial investment could either amplify or offset the historical seasonal tendencies highlighted in the data.[5][6] For investors watching the upcoming window, the interaction between policy headlines, industrial demand indicators and sector risk appetite may prove as important as the company’s own execution.

Sector positioning and valuation lens

Within the broader chip universe, Analog Devices is often viewed as a diversified analog and mixed-signal player, with revenue spread across industrial, automotive, consumer and communications applications rather than being concentrated in a single high-profile end market.[1][5] That profile can make the stock behave differently from pure-play AI or memory names, which have recently seen sharper swings tied to data center spending and pricing cycles.[2][4][6][7]

Recent comparative analysis has framed Micron as a potentially more attractive bet than Analog Devices on certain metrics, underscoring that some investors see better value or growth leverage elsewhere in the sector at current prices.[5] For Analog Devices, the upcoming seasonal window may therefore be interpreted less as a standalone signal and more as an additional lens through which to view its risk-reward profile relative to peers, especially if macro or policy developments shift sentiment toward industrial and automotive chip demand.

What to watch

As Analog Devices moves into this historically strong 247-day window, traders and longer-term investors will be watching how the stock behaves around several key catalysts. First, any update on earnings timing, guidance or capital allocation could quickly reshape expectations, particularly if management comments on industrial and automotive order trends or on AI-related design wins in areas such as automotive radar and health monitoring.[1][5]

Second, policy developments tied to a potential Trump 2.0 administration, including tariff proposals or incentives for domestic manufacturing, could influence how investors interpret the company’s geographic and end-market mix relative to peers.[1] A supportive policy backdrop that aligns with the historical seasonal tailwind might reinforce the pattern, while a more disruptive trade environment could introduce new volatility even if the long-run story remains intact.

Third, sector flows and sentiment across semiconductors will matter, especially as investors compare Analog Devices with AI-heavy and memory-focused names that have recently seen sharp moves on earnings and guidance.[2][4][6][7] If the stock can participate in broader upswings while managing intraperiod drawdowns closer to the lower end of its historical range, that would be more consistent with the stronger years in the seasonal sample; deeper or more persistent selloffs would look more like the outlier episodes of 2019, 2021 or 2024.

Finally, price action inside the window itself will offer clues about whether the historical pattern is reasserting or fading: a steady upward drift with contained downside would echo the majority of past years, while choppy trading with repeated tests of support would signal that macro, policy or competitive forces are exerting more influence than the long-term seasonal tendency. For now, the data frame the window as a constructive but volatile backdrop rather than a forecast, giving investors one more tool to contextualize moves in Analog Devices over the coming months.

Sources

- [1] Forbes, “Two Contrarian Dividends With Triple-Digit Potential For Trump 2.0,” Jan 23, 2025.

- [2] The Motley Fool, “AMD Stock Slips Despite 30% Earnings Growth and Stronger-Than-Expected Guidance,” Nov 5, 2025.

- [3] Yahoo Finance, “AMD Reports August 5—Analyst Sees Q3 Upside and CPU Market Gains,” Jul 31, 2025.

- [4] CNBC, “Applied Digital stock climbs 16% as AI demand fuels data center growth,” Oct 10, 2025.

- [5] Forbes, “Micron Stock A Better Bet Than Analog Devices?,” Oct 13, 2025.

- [6] Reuters, “AMD forecast disappoints investors, shares fall,” Aug 5, 2025.

- [7] MarketBeat, “3,403 Shares in Taiwan Semiconductor Manufacturing Company Ltd. Purchased by Value Partners Investments Inc.,” Sep 14, 2025.