Rollins, Inc. (ROL) trades inside a historically strong seasonal window

Rollins, Inc. is moving through a long seasonal stretch that has delivered steady double-digit gains in past years, as the pest-control leader rides a strong year-to-date advance and fresh Wall Street attention.

Key takeaways

- Rollins, Inc. is in a 225-day seasonal window that has historically been favorable for long positions, with a clear upside bias over the past decade.

- The pattern covers 10 prior years starting on Dec 9 and shows a 100% Percent Profitable record, with 10 winners and 0 losers across the sample.

- Average profit across those winning years is 16.55%, supported by a Sharpe ratio of 1.27 that points to strong risk-adjusted outcomes.

- The TradeWave Ratio of 2.2 indicates that price has typically traveled meaningfully in the trade direction within the window, beyond just modest drift.

- Historical maximum favorable moves have often been sizable, but adverse excursions within the window have at times exceeded 10%, underscoring meaningful drawdown risk even in winning years.

- With Rollins already up about 26% year to date, this seasonal backdrop adds another layer of context as investors weigh macro uncertainty and new analyst coverage.

According to historical data from TradeWave.ai, this part of the calendar has shown a distinct pattern for Rollins over the past decade. The next section looks at how that seasonal tendency lines up with today’s fundamentals and price action.

Seasonal window

This seasonal window is currently underway, spanning 225 days, and has historically been a strong stretch for Rollins, Inc. as a long trade. The stock is up about 26% so far in 2025, putting this year’s move firmly in positive territory as the company benefits from steady demand in the pest-control industry.[1] That combination of a constructive seasonal regime and a solid year-to-date gain gives investors a data-backed backdrop for thinking about how the next several months could differ from a typical year.

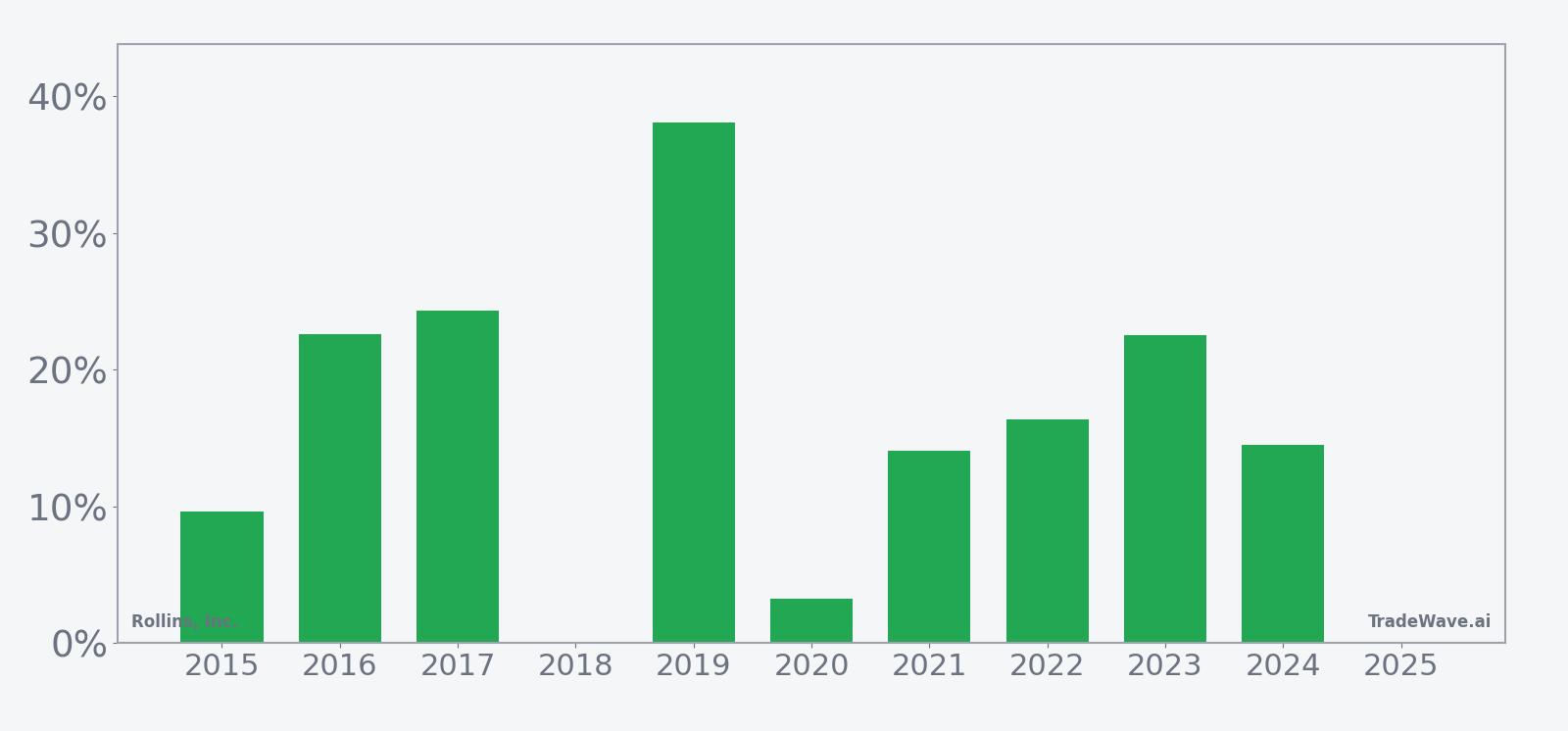

Historically, this long-biased window has produced a 100% Percent Profitable record, with 10 winning years and no losing years in the sample. Average profit across those years is 16.55%, with a median outcome of 15.44%, suggesting that gains have not been driven solely by a single outlier year but by relatively consistent double-digit advances.

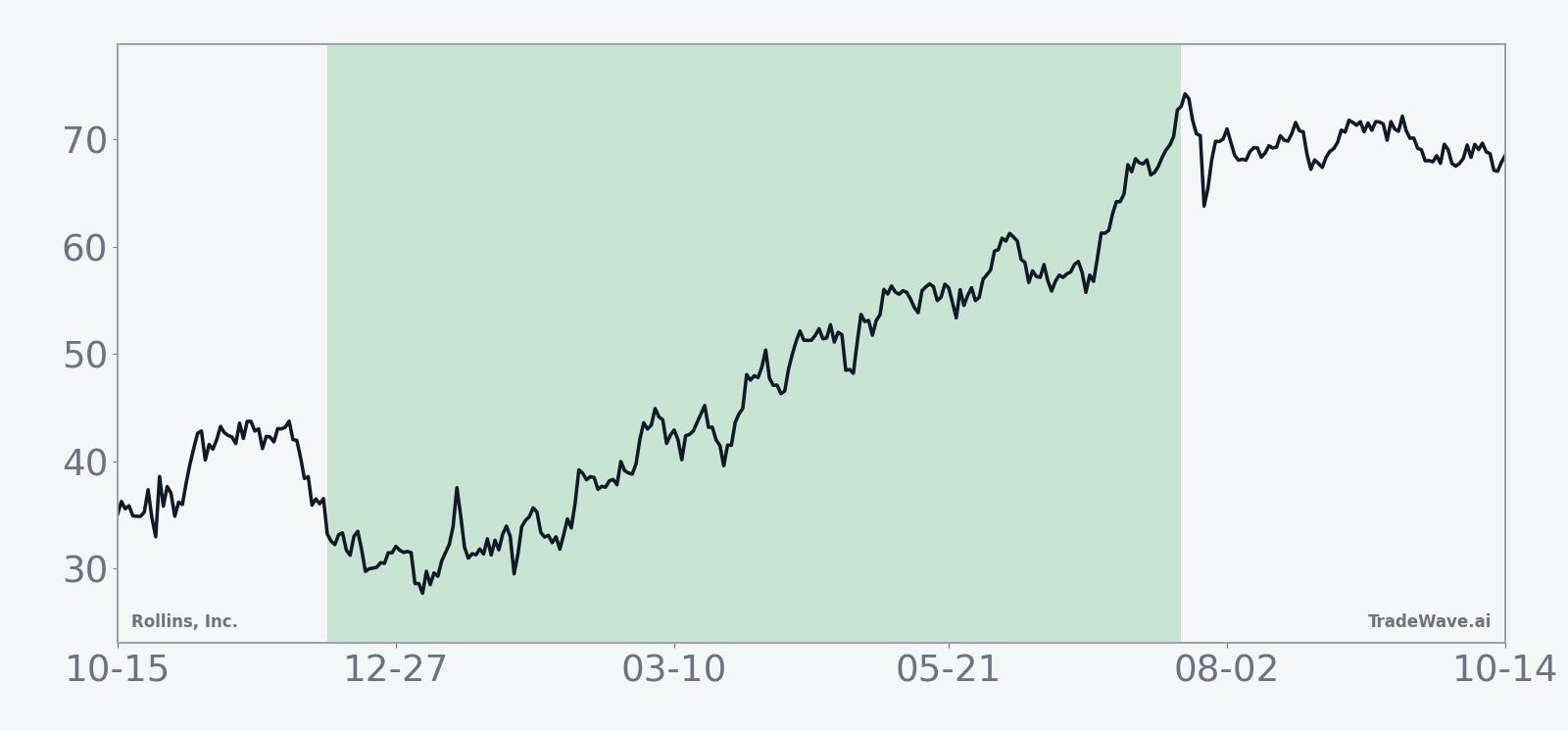

The per-year breakdown shows that 2019 was the strongest instance, with a net return of 38.13% from entry to exit, while 2018 was the softest, effectively flat at 0.0% despite a mid-window rally and drawdown. In several years, including 2016, 2017, 2022 and 2023, net returns clustered in the mid-teens to low-20s, reinforcing the impression of a durable upside tendency rather than a sporadic pattern.

The historical seasonal average suggests that gains for Rollins have tended to build steadily across the window rather than arriving in a single burst. The trend profile is dominated by long-trend readings, with “Trend Long” at 90 and “Trend Short” at 0, indicating that in most years the path of returns has leaned upward for the majority of the period.

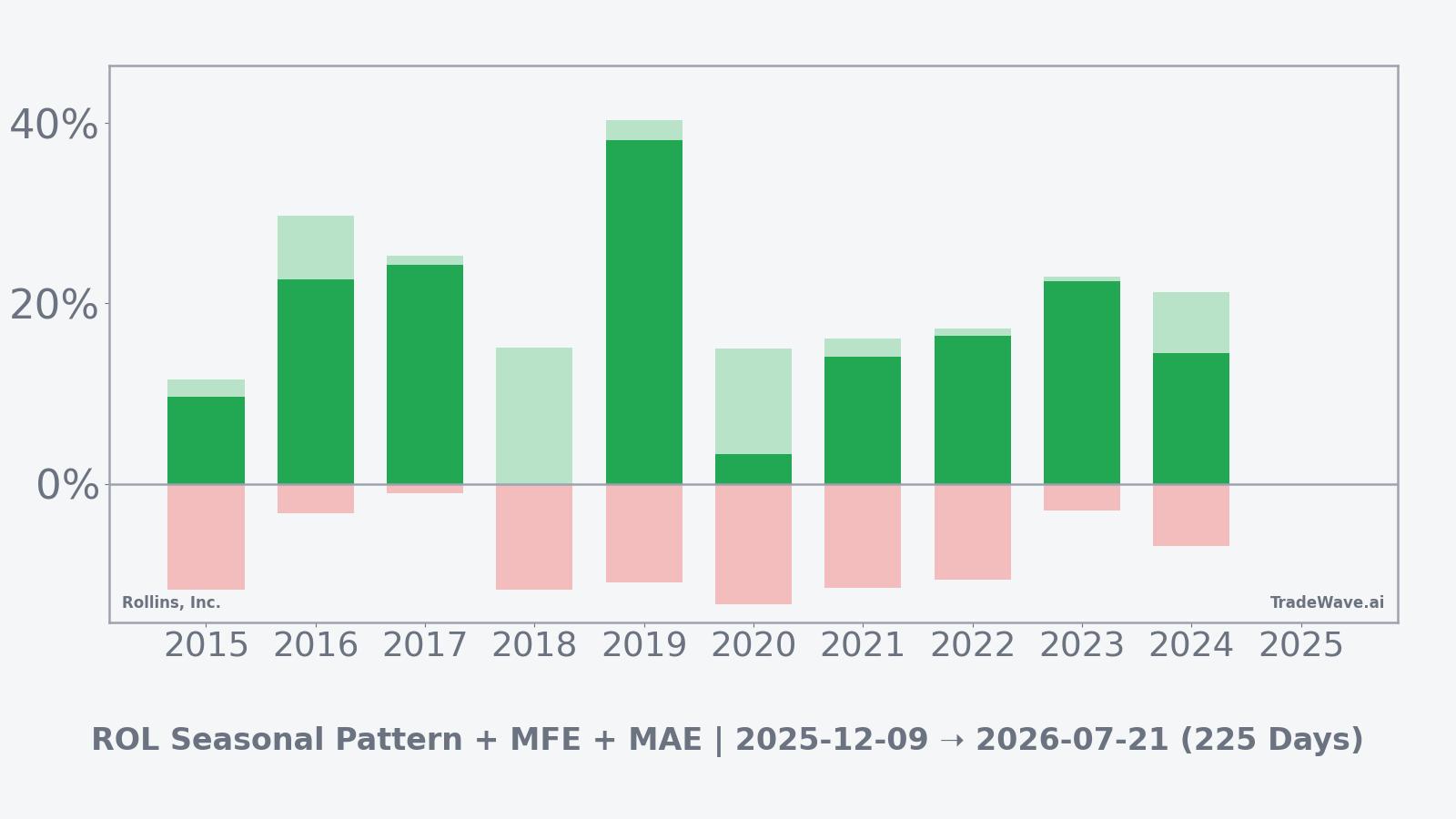

A combined view of net returns and intraperiod swings highlights how upside and downside have interacted within this window.

Maximum favorable moves within the window have often been larger than the final net gains, with several years showing peak run-ups above 20%, while maximum adverse excursions have at times reached into double digits, particularly in 2015, 2018, 2019, 2020 and 2022. That profile points to a window where the long direction has historically been rewarded, but where investors have also had to tolerate meaningful volatility and interim drawdowns before the pattern played out. Taken together, the historical pattern defines the quantitative seasonal backdrop for the current period.

History does not guarantee future results, and adverse excursions can be large even in windows that ultimately finish higher.

Price and near-term drivers

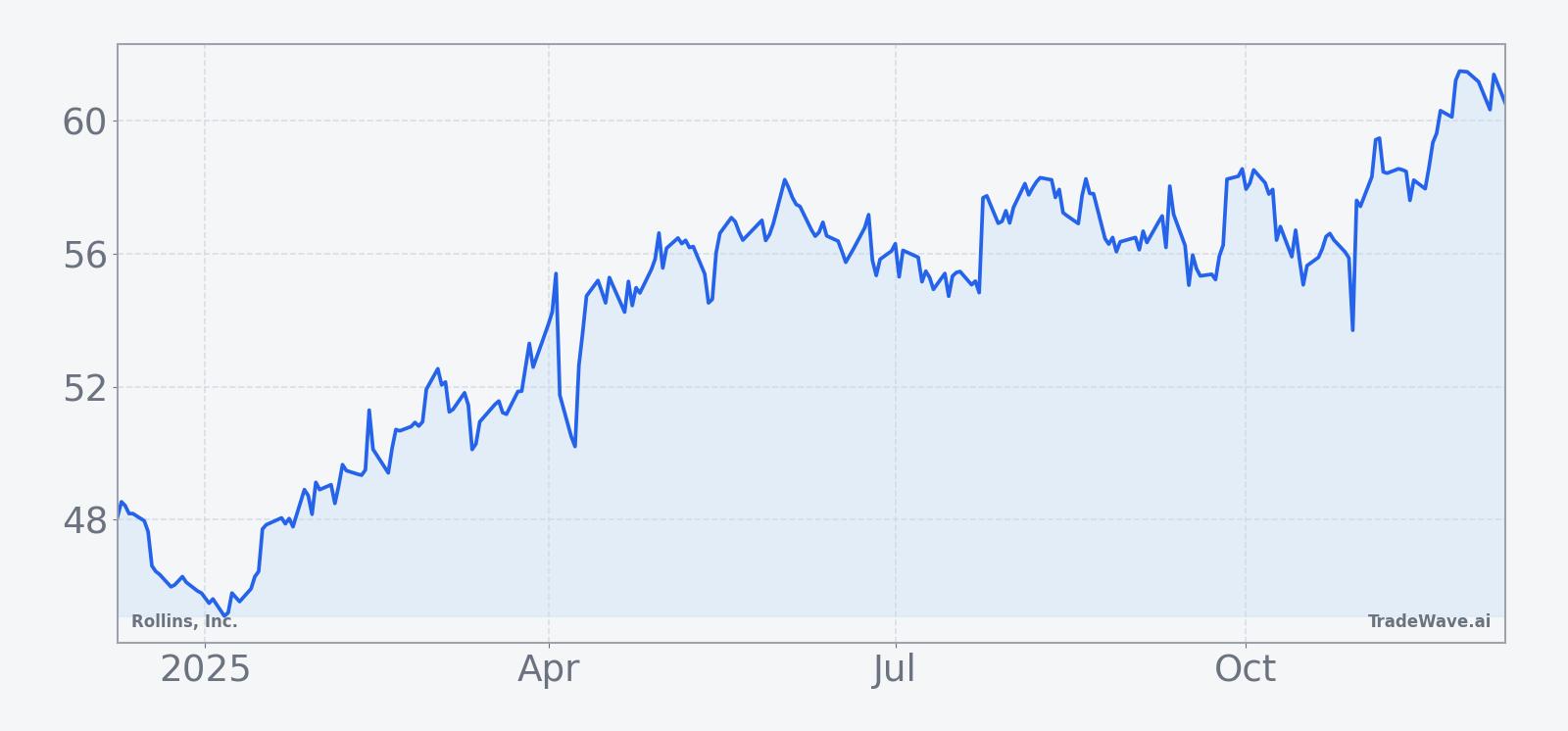

Rollins shares have climbed about 26% year to date, outpacing many broader equity benchmarks as investors continue to favor the company’s recurring-revenue pest-control model and defensive characteristics.[1] The move has unfolded against a backdrop of macroeconomic uncertainty, where investors have gravitated toward businesses seen as less sensitive to economic cycles.

That resilience has not gone unnoticed on Wall Street. In late September, J.P. Morgan initiated coverage of Rollins with an overweight rating and a $70 price target, citing the company’s “resilient business model and vast market opportunity” in the multibillion-dollar pest-control industry.[1] The bank framed Rollins as a way to “beat the market for the long term” by tapping into steady demand for termite and pest services, a thesis that aligns with the stock’s strong multi-year performance profile.

Sector specialists point out that pest control has become a structural growth story, supported by urbanization, climate dynamics and rising awareness of health and property risks tied to infestations.[1] Within that context, Rollins has focused on consolidating a fragmented industry and expanding its service footprint, which has helped smooth earnings through different parts of the economic cycle.

At the same time, analysts note that macro uncertainty remains a key backdrop for the stock, from interest-rate policy to consumer and commercial spending trends.[1] For a company like Rollins, which blends defensive characteristics with acquisition-driven growth, that environment can cut both ways: investors may reward its stability, but they may also scrutinize valuation more closely if risk-free yields stay elevated.

Consensus data compiled by LSEG and cited by CNBC show that the broader analyst community currently rates Rollins at Hold, with a consensus price target around $70 per share.[1] That stance reflects a balance between appreciation for the company’s durable growth profile and some caution about how much of that story is already embedded in the stock after its strong run.

The chart below situates the latest move in its recent multi-month context.

Macro and sector backdrop

Rollins’ seasonal strength is unfolding against a macro environment that remains unsettled, with investors weighing the path of inflation, interest rates and economic growth.[1] In such periods, companies with recurring revenue and essential services often attract attention as potential havens within equities, particularly when their end markets are less discretionary.

Within the pest-control industry, Rollins is seen as a dominant player with a long runway for consolidation and organic expansion.[1] The sector’s growth is underpinned by structural drivers such as aging housing stock, regulatory standards and climate-related shifts that can extend pest seasons, all of which support demand for ongoing service contracts.

For investors, that combination of macro uncertainty and sector resilience can make timing more important. A historically supportive seasonal window does not override valuation or earnings risk, but it can help frame how Rollins has tended to behave when similar macro conditions have intersected with this part of the calendar.

Valuation and expectations

With the stock already up strongly this year, valuation is a central part of the debate around Rollins. The Hold consensus from LSEG’s analyst survey suggests that, at current levels, many on the Street see the shares as fairly valued relative to their growth prospects, even as some houses like J.P. Morgan argue there is still room for upside.[1]

While detailed earnings estimates were not provided in the latest data, the tone of recent coverage emphasizes long-term compounding rather than short-term surprises.[1] That framing is consistent with the company’s history of steady, incremental growth and with the seasonal pattern that has tended to reward patience over a multi-month horizon.

Dividend yield and traditional valuation multiples remain part of the picture, but for many investors the key questions center on whether Rollins can continue to execute on acquisitions, maintain pricing power and defend margins in a shifting cost environment. Those fundamentals will ultimately determine whether the stock can keep tracking its historical seasonal tendency or diverge from it.

What to watch in this window

For traders and longer-term investors alike, the current 225-day seasonal window offers a structured way to think about how Rollins might trade into mid-2026. Historically, the pattern has favored the long side with consistent double-digit gains, but it has also featured notable intraperiod drawdowns, particularly in years like 2015, 2018, 2019 and 2020 where adverse moves exceeded 10% before the window closed higher.

One focal point will be upcoming earnings updates and any commentary on acquisition activity, pricing and customer retention, which can either reinforce or challenge the perception of Rollins as a steady compounder. Investors will also be watching how the stock behaves around key technical levels established during this year’s advance, since past seasonal windows have often seen rallies punctuated by sharp but temporary pullbacks.

Macro developments remain another key variable. If economic data or policy shifts change the market’s appetite for defensive growth names, that could influence how closely Rollins tracks its historical seasonal path. A continuation of the stock’s tendency to grind higher through volatility would be consistent with the long-biased pattern, while a sustained break in trend or unusually deep drawdown would mark a departure from the last decade’s behavior.

Finally, investors may want to monitor how analyst sentiment evolves relative to the current Hold consensus and J.P. Morgan’s more constructive stance.[1] Upgrades, downgrades or target changes could act as catalysts within the seasonal window, either amplifying the historical upside tendency or contributing to a more muted outcome. In that sense, the seasonal data provide a backdrop, while fundamentals, macro conditions and market positioning will determine how this particular year ultimately fits into the pattern.

Sources

- CNBC: JPMorgan says bet on termites with Rollins (Sep 28, 2025)